Decentralized Finance (DeFi) is a financial ecosystem built on blockchain technology. It allows users to access financial services without traditional intermediaries.

DeFi leverages smart contracts on blockchain networks like Ethereum to provide financial services. These services include lending, borrowing, trading, and earning interest, all without relying on banks or other centralized entities. Users maintain control over their assets, increasing transparency and reducing the risk of fraud.

DeFi platforms operate 24/7 and are accessible to anyone with an internet connection. This democratizes finance, making it available to people worldwide. As DeFi continues to grow, it promises to revolutionize the traditional financial system by making it more inclusive and efficient.

The Rise Of Decentralized Finance

Decentralized Finance, or DeFi, is revolutionizing the financial world. Unlike traditional finance, DeFi operates without intermediaries. This means no banks or brokers. Instead, DeFi uses blockchain technology. This ensures transparency, security, and accessibility for all users.

Origins And Evolution

DeFi started with the creation of Bitcoin in 2009. Bitcoin introduced the idea of decentralized money. In 2015, Ethereum expanded this concept. It introduced smart contracts. These are self-executing contracts with terms directly written into code.

Over the years, DeFi has grown rapidly. New platforms and protocols emerge regularly. They offer services like lending, borrowing, and trading. All these without needing traditional banks.

Comparing Traditional And Decentralized Finance

| Aspect | Traditional Finance | Decentralized Finance |

|---|---|---|

| Intermediaries | Relies on banks and brokers | Operates without intermediaries |

| Transparency | Limited and controlled | Fully transparent and open |

| Accessibility | Restricted by geography and status | Accessible to anyone with internet |

| Security | Centralized and prone to breaches | Decentralized and more secure |

Traditional Finance relies on trusted intermediaries. These include banks and brokers. They control financial transactions and services. Decentralized Finance eliminates these intermediaries. Instead, it uses blockchain technology. This ensures more transparency and security.

In traditional finance, transparency is limited. Financial institutions control most information. In DeFi, everything is open and transparent. Anyone can check transactions on the blockchain.

Access to traditional finance is often restricted. Factors include geography and social status. DeFi removes these barriers. Anyone with internet access can use DeFi services.

Security is another significant difference. Traditional finance is centralized. This makes it prone to data breaches. DeFi is decentralized, spreading risk across the network. This makes it more secure.

Key Components Of Defi

Decentralized Finance, or DeFi, revolutionizes traditional financial systems. It uses blockchain technology to create a transparent, secure, and open financial network. Let’s explore the key components of DeFi that make this possible.

Blockchain Foundations

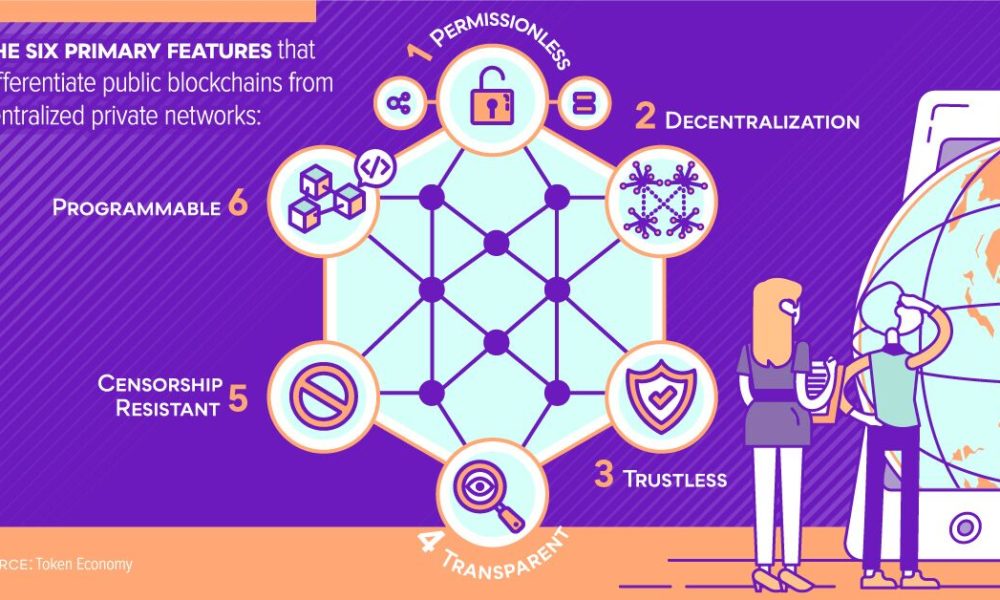

The backbone of DeFi is the blockchain. This technology is a decentralized ledger that records transactions across many computers. This ensures the data is secure, transparent, and immutable.

Here are some key features of blockchain:

- Decentralization: No single entity controls the network.

- Transparency: All transactions are visible to anyone on the network.

- Security: Advanced cryptographic methods protect the data.

Popular blockchain platforms include:

| Blockchain Platform | Key Features |

|---|---|

| Ethereum | Smart contracts, DApps |

| Binance Smart Chain | High performance, low fees |

| Solana | Fast transactions, low cost |

Smart Contracts At Work

Smart contracts are self-executing contracts with terms written in code. They automatically enforce and execute the terms when conditions are met. This reduces the need for intermediaries.

Key benefits of smart contracts include:

- Efficiency: Automates processes, reducing time and cost.

- Trust: Transparent and tamper-proof code ensures fairness.

- Security: Minimized risk of fraud and errors.

Examples of smart contract applications:

- Decentralized Exchanges (DEXs): Enable peer-to-peer trading without intermediaries.

- Lending Platforms: Allow users to lend and borrow assets.

- Stablecoins: Cryptocurrencies pegged to stable assets.

DeFi’s key components, such as blockchain and smart contracts, create a new financial ecosystem. This ecosystem is open, secure, and efficient.

Major Defi Protocols And Platforms

Decentralized Finance (DeFi) is revolutionizing the world of finance. It offers open financial services, accessible to anyone with an internet connection. This section explores some of the major DeFi protocols and platforms.

Lending And Borrowing Landmarks

Lending and borrowing are core functions in DeFi. These platforms connect lenders and borrowers without intermediaries.

- Compound: Users supply assets to earn interest or borrow against them. The platform uses a pool-based approach.

- Aave: Aave offers flash loans, which are unique in DeFi. Borrowers must repay the loan within one transaction block.

- MakerDAO: MakerDAO allows users to create DAI, a stablecoin. Users lock up collateral to mint DAI.

Decentralized Exchanges (dexs)

Decentralized exchanges (DEXs) enable users to trade cryptocurrencies directly. These exchanges do not hold user funds.

- Uniswap: Uniswap is an automated liquidity protocol. It allows users to swap ERC-20 tokens without intermediaries.

- SushiSwap: SushiSwap is a fork of Uniswap with added features. It offers yield farming and staking rewards.

- Balancer: Balancer is a flexible automated market maker (AMM). Users can create custom liquidity pools with multiple tokens.

DeFi protocols and platforms are transforming financial services. They provide users with more control and transparency.

Credit: appinventiv.com

Benefits Of Defi

Decentralized Finance (DeFi) offers many benefits. DeFi changes how we handle money. Let’s explore some key advantages. These include accessibility, inclusivity, transparency, and security.

Accessibility And Inclusivity

DeFi provides financial services to everyone. Traditional banks often exclude people. DeFi is open to all with an internet connection. No need for a bank account.

DeFi platforms are user-friendly. People in remote areas can access them. This promotes financial inclusion. You can lend, borrow, and trade without intermediaries.

Transparency And Security

DeFi operates on blockchain technology. Blockchain ensures transparency. All transactions are public. Anyone can verify them.

Security is a cornerstone of DeFi. Smart contracts automate processes. They reduce the risk of human error. DeFi platforms are often audited. This boosts trust and reliability.

| Traditional Finance | DeFi |

|---|---|

| Limited access | Open to everyone |

| Centralized control | Decentralized control |

| Opaque processes | Transparent processes |

| Manual intervention | Automated via smart contracts |

DeFi is reshaping the financial landscape. Its benefits are clear and impactful.

Risks And Challenges

Decentralized Finance (DeFi) is revolutionizing the financial sector. But, it comes with significant risks and challenges. Understanding these can help you make informed decisions.

Regulatory Hurdles

DeFi platforms often operate outside traditional financial regulations. This can lead to legal issues. Governments worldwide are scrutinizing DeFi activities. They aim to protect investors and maintain financial stability. Regulatory uncertainty can affect DeFi’s growth and adoption.

Security Concerns And Vulnerabilities

Security is a major concern in DeFi. Smart contracts can have bugs or vulnerabilities. Hackers can exploit these to steal funds. DeFi platforms are attractive targets for cyber-attacks. Ensuring security requires constant updates and audits.

| Risk Type | Description |

|---|---|

| Smart Contract Bugs | Code errors that can be exploited by hackers. |

| Regulatory Risks | Legal issues due to lack of clear regulations. |

| Market Volatility | High price fluctuations in DeFi assets. |

Being aware of these risks can help you navigate the DeFi space safely. Always do your own research and stay updated.

Credit: ruralhandmade.com

Defi And Cryptocurrencies

Decentralized Finance (DeFi) is changing the world of finance. It uses blockchain technology and cryptocurrencies. DeFi removes the need for central banks and institutions. People can trade, lend, and borrow directly with each other.

The Role Of Stablecoins

Stablecoins play a crucial role in DeFi. They are a type of cryptocurrency. Their value is pegged to a stable asset like the US dollar. This makes them less volatile compared to other cryptocurrencies.

Stablecoins provide a reliable medium of exchange. They ensure that users can avoid the high volatility of other digital assets. Here are some popular stablecoins:

- USDT (Tether)

- USDC (USD Coin)

- DAI

Tokenomics And Governance Tokens

Tokenomics is the study of the economics of tokens in a blockchain ecosystem. It involves the creation, distribution, and management of tokens. Governance tokens are a key part of DeFi ecosystems.

Governance tokens give holders the right to vote on project decisions. This includes updates, new features, and changes to the protocol. Examples of governance tokens include:

- COMP (Compound)

- MKR (MakerDAO)

- AAVE (Aave)

Governance tokens ensure that the community has a say in the project’s future. This decentralized approach promotes fairness and transparency.

Impact On Traditional Banking

Decentralized Finance (DeFi) is shaking up the traditional banking world. It offers new ways to manage money, bypassing traditional banks. The impact is profound, bringing both challenges and opportunities.

Disruption And Competition

DeFi creates disruption by offering banking services without banks. Traditional banks face competition as DeFi platforms grow. This shift changes how we view financial services.

- Lower fees

- Faster transactions

- Greater accessibility

DeFi platforms often have lower fees. They enable faster transactions. They make financial services more accessible.

| Feature | Traditional Banks | DeFi Platforms |

|---|---|---|

| Fees | High | Low |

| Transaction Speed | Slow | Fast |

| Accessibility | Limited | Global |

Collaborations And Integrations

Many traditional banks are now exploring collaborations with DeFi platforms. They see the potential for integrations to improve services.

- Joint ventures

- Shared technologies

- Enhanced security

Banks and DeFi platforms are forming joint ventures. They share technologies to offer better services. This partnership enhances security for users.

Traditional banks are adapting to survive. They integrate DeFi solutions. This change benefits everyone.

Credit: www.visualcapitalist.com

The Future Outlook Of Defi

Decentralized Finance (DeFi) is changing how we think about money. This innovative field is growing fast and offers many possibilities. The future of DeFi looks bright with exciting advancements ahead. Let’s explore some key areas that will shape DeFi’s future.

Technological Advances

Technology plays a big role in DeFi’s future. Blockchain technology keeps getting better. These advancements make transactions faster and cheaper. Smart contracts are also becoming more secure and efficient. This helps create trust among users.

Another key technology is interoperability. Different blockchains can now work together easily. This opens up many new possibilities. Privacy technologies are also improving. They help keep user data safe and secure.

| Technology | Impact |

|---|---|

| Blockchain | Faster and cheaper transactions |

| Smart Contracts | More secure and efficient |

| Interoperability | Better blockchain cooperation |

| Privacy Technologies | Enhanced data security |

Mainstream Adoption Scenarios

DeFi is slowly entering the mainstream. More people are using DeFi platforms every day. Financial institutions are also showing interest. Some are starting to invest in DeFi projects.

Governments and regulators are looking into DeFi too. They want to create rules that protect users. This can help DeFi gain more trust and acceptance.

Education and awareness are key to mainstream adoption. People need to understand how DeFi works. This will help them feel more comfortable using it.

- More people using DeFi platforms

- Financial institutions investing in DeFi

- Governments creating protective regulations

- Increased education and awareness

The future of DeFi is full of possibilities. Technological advances and mainstream adoption will shape its path. Stay tuned for more exciting developments!

Frequently Asked Questions

What Is Decentralized Finance (defi)?

Decentralized Finance, or DeFi, refers to financial services built on blockchain technology. It allows users to conduct transactions directly without intermediaries. This system aims to provide more accessible, transparent, and secure financial services.

How Does Defi Work?

DeFi uses smart contracts on blockchain platforms like Ethereum. These contracts automatically execute transactions when conditions are met. This eliminates the need for intermediaries, reducing costs and increasing efficiency.

What Are The Benefits Of Defi?

DeFi offers numerous benefits, including lower fees, greater accessibility, and enhanced security. It allows anyone with internet access to participate in financial activities without traditional banking barriers.

Is Defi Secure?

DeFi’s security depends on the underlying blockchain and smart contract code. While generally secure, vulnerabilities can exist. Users should research and use trusted platforms to minimize risks.

Conclusion

Decentralized Finance is reshaping the financial landscape with its innovative solutions. It offers greater transparency, security, and accessibility. Embracing DeFi can lead to more financial freedom and opportunities. Stay informed and explore the potential of this rapidly evolving sector. The future of finance looks more decentralized and promising than ever.